Introduction to Raydium and Solana

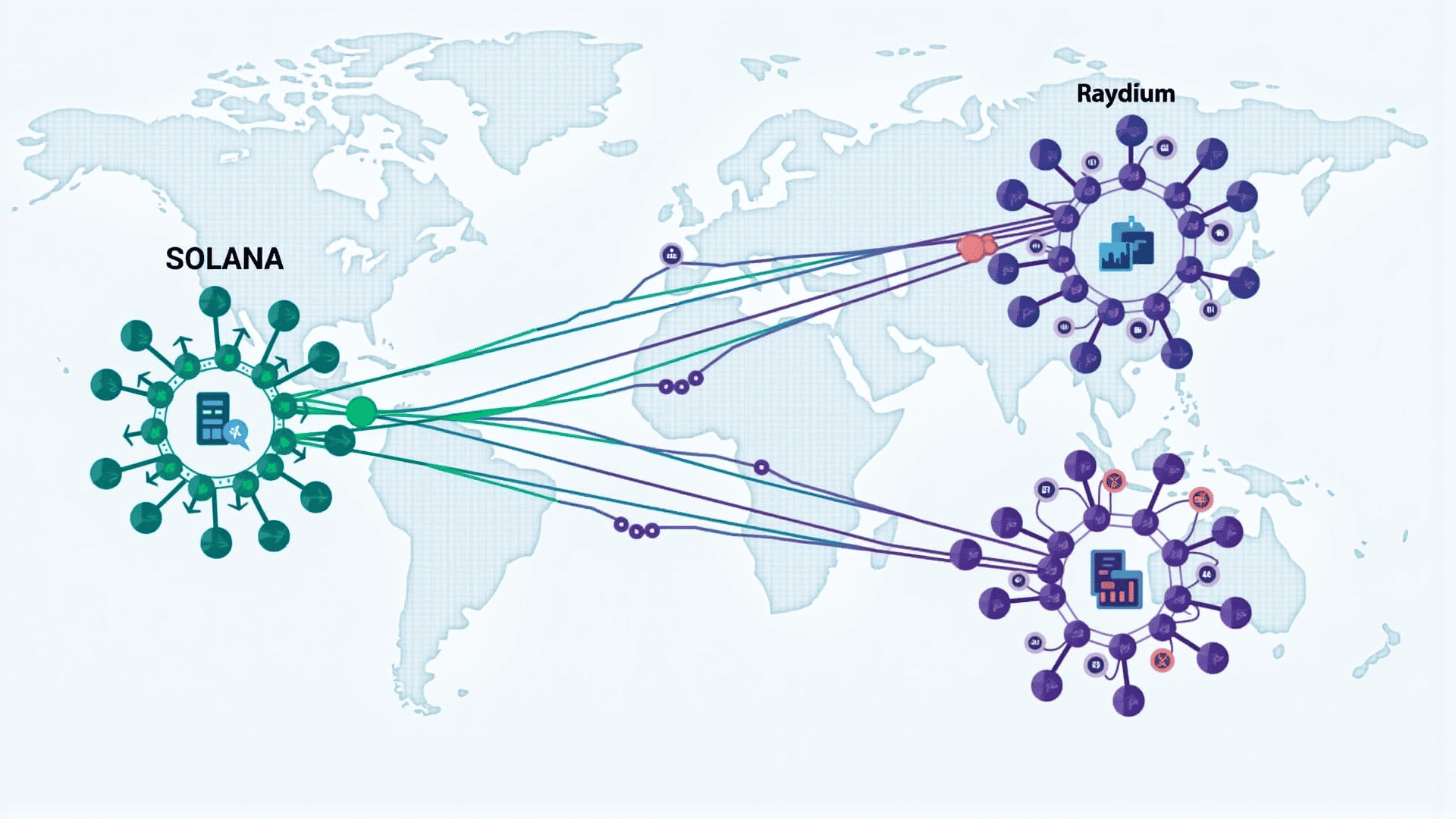

Raydium stands as a paragon of decentralized finance, seamlessly entwined with the Solana ecosystem, proffering unprecedented strides in DeFi innovation. As a high-octane automated market maker (AMM) and liquidity provider, Raydium transcends conventional limitations by harnessing Solana's lightning-speed blockchain technology. The symbiotic alliance between Raydium and Solana facilitates unparalleled trade execution and liquidity provision, thereby revolutionizing user experience within the DeFi landscape.

At the core of Raydium's innovation is its deep liquidity pools, which not only ameliorate the trading experience but also endow participants with lucrative yield opportunities. By accessing Solana's decentralized exchange (DEX) Serum, Raydium amplifies liquidity aggregation through a shared order book, fostering an ecosystem that thrives on connectivity and scalability. This integration ensures traders experience minimal slippage and lower transaction costs, ultimately democratizing access to a myriad of decentralized applications.

Moreover, Raydium's seamless interoperability with Solana's infrastructure epitomizes a paradigm shift in how decentralized financial protocols operate, manifesting a robust framework that accentuates security, efficiency, and interoperability. By catalyzing cutting-edge innovations, Raydium not only elevates existing DeFi operations but also sets a precedent for future advancements in the expansive realm of blockchain technology. Those looking to delve deeper into the intricacies of Raydium's functionalities within the Solana paradigm can further explore the intricacies and applications in Get started with Raydium.

Raydium's Influence on Decentralized Exchanges

Raydium stands as a formidable pillar in the realm of decentralized exchanges on the Solana blockchain, delivering unparalleled upgrades in trading efficiency and liquidity provision. This protocol is particularly noteworthy due to its integration of an automated market maker (AMM) with an order book-based trading experience, a feature that is scarcely seen in other DeFi platforms. By employing this hybrid mechanism, Raydium facilitates rapid transactions and slashes latency, thereby catering to traders who demand swiftness and reliability in volatile markets.

One of Raydium's crowning achievements lies in its sophisticated liquidity provision services. The protocol not only attracts liquidity through incentivized yield farming but also amplifies it by tapping into Solana's high throughput capability. This results in tighter spreads and reduced slippage, which are indispensable for traders seeking precision in execution. Furthermore, Raydium's feature of ultra-fast settlement, along with its innovative dual-pricing system, fosters an environment where sophisticated traders can execute complex strategies with minimal transactional friction.

Essentially, Raydium is transforming the paradigm of decentralized exchanges by melding the efficiencies found in centralized exchanges with the transparency and security of DeFi ecosystems. For those keen to delve deeper into the intricacies of how Raydium's liquidity pools enhance trading precision, more detailed insights can be found in resources like "Understanding liquidity pools". New users interested in exploring Raydium's capabilities can Get started with Raydium to discover more about its functionalities and benefits.

Partnerships and Collaborations

Raydium has astutely positioned itself within the burgeoning Solana ecosystem through a series of strategic alliances that not only bolster its own growth but also drive the broader evolution of decentralized finance (DeFi). By leveraging Solana's high-speed blockchain capabilities, Raydium has become a pivotal player, facilitating more efficient and scalable decentralized exchanges and automated market-making.

A noteworthy collaboration is Raydium's integration with Serum, Solana's premier decentralized exchange. This partnership enhances liquidity provision and trading efficiency, enabling users to tap into the extensive liquidity pools and order book of the Serum network. The synergy between Raydium's automated market maker and Serum's limit order capability creates a unique hybrid model that transcends typical DeFi offerings.

Moreover, Raydium's alliance with Solana-based projects like Solrise Finance and Mercurial Finance signifies a concerted effort to foster a more robust financial infrastructure. By collaborating with Solrise Finance, Raydium aims to simplify asset management on Solana, enhancing user accessibility and simplifying investment strategies. The partnership with Mercurial Finance, on the other hand, focuses on optimizing stablecoin liquidity and efficiency within the Solana ecosystem, ensuring that users benefit from low slippage and competitive rates.

These collaborations are instrumental in accelerating DeFi growth on the Solana blockchain, underscoring Raydium’s role as a catalyst for innovation. By creating a cohesive and symbiotic network of partnerships, Raydium not only contributes to the proliferation of DeFi services but also fortifies its position as an integral component of Solana's expansive network. This strategic alignment promotes a virtuous cycle of innovation, liquidity, and adoption, setting the stage for sustainable growth within the decentralized financial landscape.

If you're interested in getting started with Raydium on Solana, you can explore the innovative features that Raydium offers. Understanding how Raydium enhances liquidity pool capabilities can also provide deeper insights into its role in strengthening the DeFi ecosystem.

Raydium's Role in DeFi Growth

Raydium has emerged as a quintessential actor within the decentralized finance (DeFi) ecosystem, not merely for its infrastructural offerings on the Solana blockchain but for its pathfinding innovations that bolster the momentum of DeFi proliferation. At its core, Raydium functions as an automated market maker (AMM) and liquidity provider, dexterously facilitating efficient, on-chain liquidity provisioning with startling speed and reduced slippage, thanks to Solana's high-throughput framework.

What distinguishes Raydium from its contemporaries is its pioneering use of on-chain liquidity for a central limit order book, providing a paradigm shift in the way DeFi platforms operate. By interfacing with the Serum DEX's order book, Raydium enables liquidity pools to access a colossal pool of capital, thereby granting users superior price discovery and optimal trading strategies. This symbiosis between liquidity pools and order books elucidates Raydium's adaptive ingenuity in the DeFi terrain.

Moreover, Raydium's penchant for innovation is evident in its "Fusion Pools," which forge synergistic alliances between projects to enhance capital efficiency and network-wide user engagement. Through these fusion initiatives, Raydium doesn't just nurture individual projects but enriches the entire DeFi ecosystem by fostering interoperability and shared liquidity. This not only remedies the inefficiencies of fragmented liquidity but also supercharges DeFi's overall growth trajectory.

Furthermore, Raydium's intuitive interface and user-centric strategies, such as yield farming and innovative reward systems, further incentivize robust engagement. Its ambitious vision of cross-chain integrations promises to blur the lines between distinct blockchains, catalyzing a new epoch of interconnected DeFi solutions. As Raydium continues to iterate and evolve, its contributions to the DeFi landscape represent adaptive intelligence and a proclivity for collaborative progression. Through its initiatives, Raydium remains a stalwart propellant in the burgeoning DeFi narrative.

Getting Started with Raydium

Embarking on your journey with Raydium on the Solana network necessitates a keen understanding of both the technological landscape and the operability intricacies involved. The inaugural step is to ensure you have a compatible cryptocurrency wallet, such as Sollet or Phantom, that seamlessly integrates with the Solana ecosystem. Once your wallet is configured, obtaining Solana (SOL) tokens is imperative, as they are essential for transaction fee coverage within the network.

Navigating to the Raydium interface, found at its official website, can initially feel daunting given its multifaceted functionality, but it is here that you can execute swaps, provide liquidity, and participate in yield farming. The swap function, which underpins Raydium's core utility, facilitates the exchange of tokens with minimal slippage due to its integration with the Serum decentralized exchange. For liquidity provision, users must pool an equivalent value of two tokens, an action that effectively enhances trading volume and can yield substantial returns in the form of trading fees and native RAY tokens.

A salient feature of Raydium is its Accelerator platform, which propels new projects by offering Initial DEX Offerings (IDOs). Participation here not only necessitates possessing a certain quantity of RAY tokens but also often requires early access whitelisting.

In light of the rapid evolution within decentralized finance, keeping abreast of protocol updates through community forums and resources is vital. Engaging with veteran users on platforms like Discord or Telegram can provide real-time insights and strategic advice, ushering you into the Raydium community with aplomb.